The deadline for submitting financial statements for the first quarter of 2002 is approaching. At the same time, from January 1, 2002, all commercial organizations keep records in accordance with the new chart of accounts. How does this reflect on the balance sheet? In this article, Professor of St. Petersburg State University Viktor Vladimirovich Patrov will talk about the changes and the procedure for filling out the balance sheet in accordance with the new chart of accounts.

A sample balance sheet form as one of the most important forms of financial reporting was approved by order of the Ministry of Finance of Russia dated January 13, 2000 No. 4n. To make it easier to fill out the balance sheet, after the names of its items, the account number is indicated in parentheses, on the basis of which numerical indicators for a particular type of funds (in assets) or their source (in liabilities) are indicated.

From January 1, 2002, all accountants in our country switched to a new chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n. The changes made to the chart of accounts can be divided into two groups:

Unfortunately, the above changes were not reflected in the sample balance sheet form. The purpose of this article is to help accountants correctly reflect the corresponding amounts for balance sheet items based on the new chart of accounts (see Tables 1 and 2).

| Balance sheet item | Line code | Account numbers | |

|---|---|---|---|

| According to the old plan | According to the new plan | ||

| Construction in progress | 130 | 07,08,16,61 | 07,08,16,60 |

| Long-term financial investments | 140 | 06, 82/2 | 58,59 |

| Raw materials, supplies and other similar assets | 211 | 10,12,13,16 | 10,15,16,60 |

| Costs in work in progress (distribution costs) | 213 | 20,21,23,29,30,36, 44 | 20,21,23,29,44,46 |

| Finished products and goods for resale | 214 | 16,40,41 | 15,16,20,41,42,43,60 |

| Future expenses | 216 | 31 | 97 |

| Buyers and clients | 231 | 62,76,82/1 | 62,76,63 |

| Bills receivable | 232 | 62 | 62,76 |

| Debt of subsidiaries and dependent companies | 233 | 78 | 58,60,62,75,76 |

| Advances issued | 234 | 61 | 60 |

| Buyers and clients | 241 | 62,76,82/1 | 62,76,63 |

| Bills receivable | 242 | 62 | 62,76 |

| Debt of affiliates and subsidiaries | 243 | 78 | 58,60,62,75,76 |

| Advances issued | 245 | 61 | 60 |

| Short-term financial investments | 250 | 56,58,82/2 | 58,59 |

| Other cash | 264 | 55,56,57 | 55,57 |

| Authorized capital | 410 | 85 | 80 |

| Extra capital | 420 | 87 | 83 |

| Reserve capital | 430 | 86 | 82 |

| Social Sphere Fund | 440 | 88 | 84 |

| Targeted funding and revenues | 450 | 96 | 86 |

| Retained earnings from previous years | 460 | 88 | 84 |

| Uncovered loss from previous years | 465 | 88 | 84 |

| Retained earnings of the reporting year | 470 | 88 | 84 |

| Uncovered loss of the reporting year | 475 | 88 | 84 |

| Long-term loans and credits | 510 | 92, 95 | 67 |

| Short-term loans and borrowings | 610 | 90,94 | 66 |

| Bills payable | 622 | 60 | 60,76 |

| Debt to subsidiaries and dependent companies | 623 | 78 | 60,62,66,67,75,76 |

| Advances received | 627 | 64 | 62,76 |

| Debt to participants (founders) for payment of income | 630 | 75 | 70,75 |

| revenue of the future periods | 640 | 83 | 98 |

| Reserves for future expenses | 650 | 89 | 96 |

A simple change in account numbers takes place on the following lines of the balance sheet (see Table 2).

| Line code | Account name | Account number | |

|---|---|---|---|

| According to the old plan | According to the new plan | ||

| 140,250 | Provision for impairment of investments in securities | 82/2 | 59 |

| 213 | Completed stages of unfinished work | 36 | 46 |

| 214 | Finished products | 40 | 43 |

| 216 | Future expenses | 31 | 97 |

| 231, 241 | Provisions for doubtful debts | 82/1 | 63 |

| 410 | Authorized capital | 85 | 80 |

| 420 | Extra capital | 87 | 83 |

| 430 | Reserve capital | 86 | 82 |

| 440,460,465,470 | Retained earnings (uncovered loss) | 88 | 84 |

| 450 | Special-purpose financing* | 96 | 86 |

| 640 | revenue of the future periods | 83 | 98 |

| 650 | Reserves for future expenses** | 89 | 96 |

*Note: The name in the old chart of accounts is “Targeted financing and revenues.”

**Note: The name in the old chart of accounts is “Reserves for future expenses and payments.”

The remaining changes in Table 1 are due to innovations in the methodology for accounting for individual objects and facts of economic life. Let's look at them in more detail.

According to the old chart of accounts, two accounts were used to account for financial investments: 06 “Long-term financial investments” and 58 “Short-term financial investments”. The criterion for this division of financial investments into two types was the period during which the organization intended to receive income from them (more than a year - long-term, less than a year - short-term). The disadvantage of this accounting methodology was that in a number of cases it was difficult to classify financial investments in the above-mentioned context. For example, an organization bought 1,000 shares of another company for 5,000 rubles, and the accountant, when recording this transaction, must decide which account (06 or 58) to record them in. Maybe these shares will be on the organization’s balance sheet for, for example, 10 years, or maybe the organization’s management will decide to sell them in a few days (weeks, months). Based on this, the new chart of accounts for accounting for all financial investments (both long-term and short-term) uses one account 58 “Financial investments”. However, another problem arose.

As you know, in the balance sheet financial investments should be reflected in two sections: in section I “Non-current assets” - long-term (line 140) and in section II “Current assets” - short-term (line 250). Previously, for this purpose, the accountant transferred to the balance sheet the balance of accounts 06 and 58, respectively. Since financial investments are currently accounted for in one account, in order to reflect them in the balance sheet, it is necessary to take inventory as of the reporting date of the balance of account 58 “Financial investments” in order to determine which objects are on It is taken into account and for how long.

If objects are listed on this account for more than a year, their total amount is recorded in section I on line 140, and if less than a year - in section II on line 250. Moreover, in both cases, if a reserve was created for the impairment of investments in securities, taken into account on account 59 of the same name, the amount of this reserve must be deducted from the value of the securities for which this reserve was formed.

In the old chart of accounts there was account 30 “Non-capital works”, which took into account the costs associated mainly with the construction of temporary title and non-title structures. According to the new chart of accounts, costs for the construction of temporary structures should be taken into account in accounts 08 “Investments in non-current assets” (for title ones) and 23 “Auxiliary production” (for non-title ones). This must be kept in mind when filling out line 213.

The new edition of the accounting provisions “Accounting for inventories” (PBU 5/01) and “Accounting for fixed assets” (PBU 6/01) does not provide for low-value and wear-and-tear items as accounting items. Depending on their useful life, they are transferred to either fixed assets or materials. In this regard, when filling out line 211, the balance of former accounts 12 “Low-value and wear-and-tear items” and 13 “Depreciation of low-value and wear-and-tear items” will not be used.

In the old chart of accounts there was account 78 “Settlements with subsidiaries (dependent) companies”, information on which was used to fill out lines 233, 243 and 623. In the new chart of accounts, the above account is missing. To account for settlements with subsidiaries (dependent) companies, the Russian Ministry of Finance recommends using those accounts, the use of which follows from the content of one or another fact of economic life.

The parent company, subsidiaries and dependent companies are legal entities and can enter into any agreements between themselves provided for by civil law (purchase and sale, lease, loan, etc.).

The parent company entered into an agreement with its subsidiary for the sale of goods. In this case, the parent company will account for settlements with its subsidiary, which is the buyer of the goods, on account 62 “Settlements with buyers and customers”. In turn, the subsidiary will use account 60 “Settlements with suppliers and contractors” to account for settlements with the parent company, which is a supplier of goods.

Subsidiary "A" provided subsidiary "B" with a loan of 100,000 rubles. for 6 months. When transferring the loan, Company “A” makes the following entry:

Debit 58 “Financial investments” Credit 51 “Current accounts” - 100,000 rubles.

When receiving a loan, Company "B" makes the following entry:

Debit 51 “Current accounts” Credit 66 “Settlements for short-term credits and loans” - 100,000 rubles.

Thus, to account for settlements with subsidiaries (dependent) companies, instead of account 78, different accounts are used (58, 60, 62, 66, 67, 75, 76), information on which will be used to fill out lines 233, 243 and 623 of the balance sheet. To make it easier to obtain this information, the instructions for using the chart of accounts recommend that settlements with subsidiaries (dependent) companies be taken into account separately.

The new chart of accounts does not contain accounts 61 “Calculations for advances issued” and 64 “Calculations for advances received.” It is recommended that these calculations be taken into account respectively in accounts 60 “Settlements with suppliers and contractors” and 62 “Settlements with buyers and customers”. This must be kept in mind when filling out lines 130, 234 and 245 (when reflecting advances issued) and line 627 (when reflecting advances received).

The instructions for using the chart of accounts recommend that the amounts of advances issued (received) and prepayments on accounts 60 and 62 be taken into account separately. For both of these accounts at the same time, the balance can be both debit and credit, and in the balance sheet it should be shown expanded: debit - in an asset, and credit - in a liability. The number of the old account 56 “Cash documents” is indicated after the names of two balance sheet items: “Short-term financial investments” (line 250) and “Other funds” (line 264). Therefore, it is intended that the balance of this account should be shown under these above items. In our opinion, this is unlawful for the following reasons.

According to the old chart of accounts, account 56 “Cash documents” reflected two accounting objects: cash documents and own shares purchased from shareholders for their subsequent resale or cancellation. In addition, it was recommended to take into account the debts of participants acquired by business partnerships for transfer to other participants or third parties on the same account. It was recommended to reflect monetary documents on line 264, and purchased own shares (shares) on lines 250 and 252.

The correctness of this conclusion is confirmed by paragraph 40 of the methodological recommendations on the procedure for forming indicators of the organization’s financial statements, approved by Order of the Ministry of Finance of Russia dated June 28, 2000 No. 60n, which, in particular, states: “The group of articles “Short-term financial investments” reflects the actual costs of the organization for the redemption own shares from shareholders...” In addition, one of the balance sheet items for reflecting short-term financial investments is called “Own shares purchased from shareholders.”

Reflection of monetary documents in the balance sheet under the item “Other cash” (line 264) is incorrect, because monetary documents cannot be identified with cash.

Reflection of purchased own shares (shares) as part of short-term financial investments (lines 250 and 252) is illegal, because they are not financial investments. According to paragraph 43 of the regulations on accounting and financial reporting, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, financial investments include investments in government securities and investments in other organizations. Own shares (shares) are neither one nor the other.

Based on the foregoing, we believe that cash documents and own shares (shares) should be reflected in the balance sheet under the item: “Other current assets” (line 270).

According to the old chart of accounts, loans and borrowings were accounted for in different accounts:

The new chart of accounts provides only two accounts for accounting for loans and borrowings:

those. the choice of one of these two accounts is determined by the length of the period for which loans and borrowings were received (more than 1 year and less than 1 year). This must be kept in mind when filling out lines 510 and 610 of the balance sheet.

Unfortunately, even before the transition to the new chart of accounts, there were shortcomings in the methodology for compiling the balance sheet. Let's look at some of them.

Both the old and new charts of accounts provide that account 15 “Procurement and acquisition of material assets” can be used to summarize information on the procurement and acquisition of current assets.

The debit of this account collects all costs associated with the acquisition of inventories. Account 15 is credited for the cost at accounting prices of actually received and capitalized materials or goods. The resulting difference is written off from account 15 to account 16 “Deviations in the cost of material assets.”

Thus, if during the month purchased inventories arrive at the organization, and their actual cost has already been fully formed, then at the end of the month account 15 does not have a balance.

However, in practice situations often arise when the process of acquiring current assets began in one reporting period and ended in another reporting period. In this case, on the balance sheet date, account 15 will have a debit balance.

For not a single asset item is account 15 indicated in parentheses after its name. Naturally, the accountant has a question: under what balance sheet item should this balance be shown? By viewing only the sample balance sheet form, the answer to this question cannot be obtained. It should be noted that in paragraph 25 of the methodological recommendations on the procedure for forming indicators of the organization’s financial statements, it is said that this balance “... is added to the value of the balances of inventories reflected in the relevant items of the group of items “Inventories...””, that is, to the cost of materials or goods (depending on the costs of purchasing which type of these assets were recorded in the debit of account 15).

Clause 13 of the accounting regulations “Accounting for inventories” (PBU 5/01), approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, states: “An organization engaged in retail trade is allowed to evaluate purchased goods at sales value with separate accounting of markups (discounts)." In this case, the markups attributable to the balance of goods are listed as the credit balance of account 42 "Trade margin", and the balance of account 41 "Goods" shows the balance of goods at sales prices.

Paragraph 60 of the regulation on accounting and financial reporting states: “When an organization engaged in retail trade records goods at sales prices, the difference between the acquisition cost and the cost at sales prices (discounts, markups) is reflected in the financial statements as a separate item.” Paragraph 28 of the methodological recommendations on the procedure for forming indicators of an organization’s financial statements specifies where this difference should be reflected - in the appendix to the balance sheet (form No. 5).

The above-mentioned paragraph 60 of the regulation on accounting and financial reporting also states: “Goods in organizations engaged in trading activities are reflected in the balance sheet at the cost of their acquisition.” To ensure compliance with this requirement when accounting for goods at sales prices, as of the reporting date, you need to subtract the balance of account 41 “Goods” from the balance of account 42 “Trade margin” and record the resulting difference under the balance sheet item “Finished products and goods for resale” (line 214). However, account 42 is not indicated in parentheses after the title of this article, and, unfortunately, not a single regulatory document of the Russian Ministry of Finance mentions this.

For the same balance sheet item (line 214), paragraph 28 of the methodological recommendations on the procedure for generating financial reporting indicators provides for organizations providing public catering services to reflect the balances of raw materials in kitchens and pantries, as well as the balances of goods in buffets. Therefore, in parentheses after the title of this article, we indicated account 20, which in public catering takes into account raw materials and finished products in the kitchen (production).

When filling out lines 232 and 242, you need to keep in mind that the debt of other organizations on bills received from them can be taken into account not only on account 62 “Settlements with buyers and customers”, but also on account 76 “Settlements with various debtors and creditors”. The same account may reflect the organization’s debt on bills of exchange issued by it (not only in account 60 “Settlements with suppliers and contractors”, as follows from the data in line 622).

According to the old chart of accounts, settlements with government agencies for payments paid to various extra-budgetary funds (except for settlements for social insurance and welfare and health insurance) were accounted for on account 67 “Settlements for extra-budgetary payments”. This account is not included in the new chart of accounts, and to account for the above calculations, it is recommended to use account 68 “Calculations for taxes and fees”.

In this regard, when filling out the amount on line 626 “Debt to the budget”, you need to keep in mind that for this line from the balance of account 68 you should take the organization’s debt only to the budget. The remaining debt of the organization listed on this account (in particular, to extra-budgetary funds) should be shown on line 660 “Other short-term liabilities”. The same line should reflect the balance of the consumption fund (if the organization has one), accounted for in account 88, since this is a debt to its employees for activities for the development of the social sphere and material incentives.

Line 630 of the balance sheet reflects the debt to the participants (founders) for payment of income. In parentheses after the title of this article, only account 75 “Settlements with founders” is indicated. The use of only this one account will be legal if all participants (founders) of the organization are not its employees. If the participants (founders) of the organization are also its employees, then, according to the instructions for using the chart of accounts, the accrual and payment of income to them is taken into account on account 70 “Settlements with personnel for remuneration”. Therefore, in this case, to fill out the amount on line 630 of the balance sheet, you need to use the data from two accounts: 75 and 70 (in terms of accrual of income from participation).

As mentioned above, account 60 “Settlements with suppliers and contractors” may have a debit balance showing the amount of advances and prepayments issued. However, a debit balance of this account may also be in the case when an organization paid the supplier money for valuables that it has not yet actually received (they are on the way), but according to the agreement it has become the owner of these valuables. In this case, the debit balance of account 60, showing the balance of valuables in transit, should be reflected in the balance sheet not as accounts receivable, but according to those balance sheet items that reflect similar valuables already capitalized by the organization (as part of materials, goods, etc.) .

An organization as of the reporting date may have a balance in account 94 “Shortages and losses from damage to valuables.” This account number is not indicated on any balance sheet item. The question arises: where to reflect the amounts of the above shortages and losses? To correctly answer this question, it is necessary to take inventory of the balance of account 94 as of the reporting date. Amounts of shortages and losses from damage to valuables related to non-current assets should be reflected under the article “Other non-current assets” (line 150), and those related to current assets - under the article "Other current assets" (line 270).

An appendix to the balance sheet is the “Certificate of the presence of valuables recorded in off-balance sheet accounts.” The procedure for filling it out during the transition to the new chart of accounts has practically not changed, with the exception of the indicators reflected in Table 3. This change is due to the merger of two accounts (014 “Depreciation of housing stock” and 015 “Depreciation of external improvement objects and other similar objects”) into one account 010 "Depreciation of fixed assets".

To ensure the possibility of filling out the above certificate, it is necessary to organize separate accounting of housing stock objects and external improvement objects and other similar objects on account 010 (by opening separate sub-accounts or an analytical accounting system).

Taking into account all of the above, a sample balance sheet form will take the following form (see Table 4).

Table 4.

|

* Note: The line title has been changed based on the content of PBU 14/2000 “Accounting for intangible assets”

|

(qualification certificate of a professional accountant from

"____" ___________________________ _____ city №______)

"____" ___________________________ _____ G.

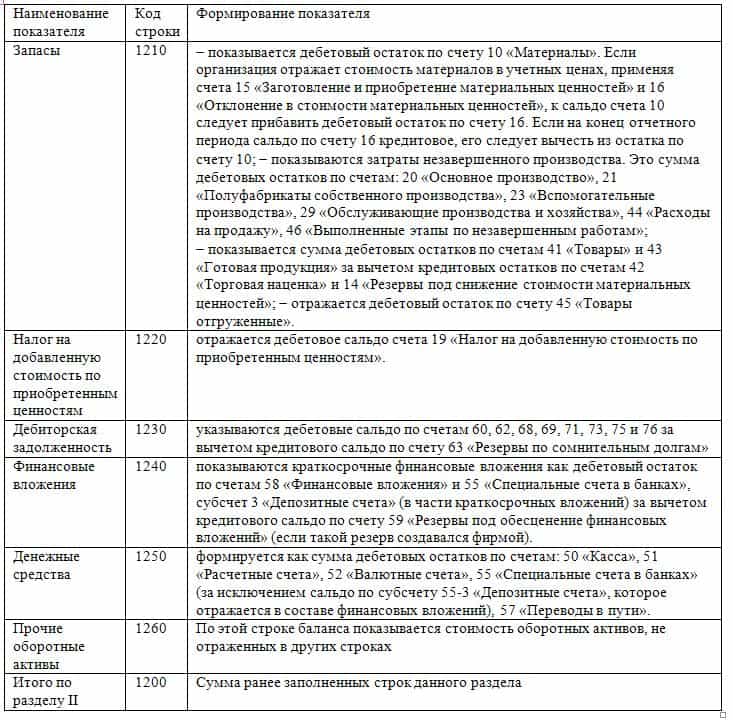

Line 1230 of the balance sheet - explanation it helps to understand the size of the receivable at the time of drawing up the document. Other balance lines are filled in using the same principle. Our article will discuss what information should be contained in the balance sheet line by line.

Each balance sheet line corresponds to a code that allows you to identify the data contained in it. The main consumers of these codes are statistical and regulatory authorities, which can carry out analytical work on them.

Currently the codes are 4 digits long. For example, line 1230 of the balance sheet, former line 240, contains accounts receivable in the transcript. This line shows the amount of debt that its partners, counterparties and other persons interacting with it have to the company in a certain period of time.

Line 230 also belonged to this category and reflected debts that could be repaid in no earlier than 12 months.

Balance sheet line codes contain very specific information:

Using a similar principle, we will selectively describe which codes correspond to the strings and provide a brief explanation of them. We will separately indicate in the table the new and old codes, since the balance must be drawn up for 3 years, and 2 years ago the previous code values were still in effect.

Line 1100 contains information about the full amount of non-current assets of the enterprise. Before the order was changed, this was line 190. The next 6 lines are elements that add up to the value of this line.

Line 1150 corresponds to the previous line 120. Data on fixed assets of the enterprise available at the time of the report is entered into it.

Line 1160 reflects information about the amount of material assets available at the enterprise, as well as investments that generate income. All data is recorded on account 03.

Line 1170, former 140, contains data on the enterprise’s investments if they are made for more than 12 months. Accounting is maintained by the debit of accounts 58 and 55, the subaccount is called “Deposits”.

Line 1180 contains the allocated tax assets. The balance of account 09 is indicated here. Line 1190 includes all non-current assets that were not mentioned above.

The previous line 210 corresponds to the current line 1210 of the balance sheet; the accounting department enters data on the remaining inventories into it.

Line 1220 of the balance sheet as before - line 220. It must contain data on VAT, which was issued by the supplier, but was not accepted for deduction until the report was drawn up. This is essentially the debit balance of account 19.

Line 1240balance sheet with transcript Previously it was line 250. It reflects investments whose maturity does not reach a year.

Line 1250 is the company's monetary assets in national and foreign currencies, as well as other resources. This refers to accounts 50, 51, 52 and 55.

Line 1260 contains all other assets that did not find a place in the above section lines.

Line 1200 in the previous version of the form was line 290balance sheet. The final results for section 2 are reflected here.

If an enterprise considers it necessary to additionally disclose information on some general line, for example 1260, it is given the opportunity to supplement the balance sheet with a detailed line, for example 12605 “Deferred expenses”.

Instead of line 300 of the old form, there is line 1600, which shows the result of adding lines 1100 and 1200. In other words, this is the balance of this section.

Line 1360 contains the total value of reserve capital.

Line 1370 is formerly line 470. It contains data on profits that have not yet been distributed.

Line 1300 corresponds to the previous one line 490balance sheet. This summarizes all the data in Section 3, devoted to the capital of the enterprise.

Line 1410 begins the section on long-term liabilities. It indicates borrowed funds with a term of more than 12 months. Accounting is maintained on account 67.

Line 1420 contains the allocated tax liabilities. The data is taken from account credit 77.

All data on lines starting with 14 is consolidated into line 1400 (previously line 590).

In the previous version of the form line 1510balance sheet with transcript was line 610balance sheet. It contains information about short-term borrowed funds (accounts 66 and 67).

Line 1520balance sheet with transcript until 2015, it was line 620. It reflects short-term debt to partners, staff, etc. Line 1530 contains the balance of account 98.

Line 1540 is liabilities reflected on the credit of account 96, the maturity of which is less than 12 months.

Line 1550 is all other obligations that are not reflected in the previous lines.

Line 1500 contains the final result for section 4.

In the previous version this line 700 of the balance sheet. This contains the result of adding all the lines for liabilities: 1300 + 1400 + 1500.

Lines starting with number 2, in particular 2110 “Revenue”, refer to Form 2 of the balance sheet. It was previously known as the income statement.

Since it is the main type of accounting reporting, it carries a meaning dedicated to the financial condition of the business entity. At the same time, a beginner may find its structure incomprehensible and confusing, because in addition to complex page numbering, one also has to deal with the concept of codes, which sometimes becomes a whole problem. This article is devoted to deciphering the lines of the balance sheet.

Download the form Balance sheet (form according to OKUD 0710001) possible by .

Simplified Balance Form available at .

Let's look at all the balance line codes by section.

This section contains information about what low-liquidity assets the company owns. Usually these are equipment, premises, buildings, intangible assets and others.

Current assets are the most highly liquid assets of an enterprise. These include goods, accounts receivable, money in cash and accounts, etc.

Codes for certain lines must be indicated in a certain column. It is worth noting that codes are needed mainly so that statistical authorities can combine information presented in different types of balance sheets into one whole. The codes are mandatory to fill out when the balance sheet being compiled must be transferred to state executive structures with further use of information on them.

In a situation where the balance sheet is prepared for a quarter or other reporting period, in order for it to be considered at internal meetings for the purpose of introducing the state of affairs or analyzing the company’s activities, it is not necessary to fill in the code lines, since they do not carry any responsibility in this case no functions.

Line coding is performed only if this reporting documentation is submitted to government agencies and is not an obligation for the internal preparation of reporting balances. Since financial statements are submitted to the tax authorities only once a year, the coding applies only to annual balance sheets.

Previously, the line code consisted of three digits. At the moment, only those codes that are specified in a special appendix to Order 66 of the Ministry of Finance are being considered. This is app #4 which sets up four digit codes for use.

The encoding of the old form differs from the new one only in that the list of these lines changes, their encoding turns into a four-digit indicator, and the detail of the information provided in the balance sheet changes slightly. The row assignments remain the same.

It should be noted that the asset has a specialized format based on the liquidity factor of the property that the organization has. The least liquid of it will be located at the very top of the column, since it is this property that remains almost unchanged from the beginning of the organization until its liquidation.

The asset lines in the new balance sheet are: 1100, 1150-1260, 1600.

A liability tends to reflect where the company gets money for its operation. And also what part of these funds is the property of the company, and what part is borrowed and requires repayment. This part of the balance sheet plays an important role, since when compared with the asset, one can accurately say whether the company has the funds to successfully continue its activities, or whether the time will soon come to “wind up shop.”

The lines reflecting the passive part of the balance are: 1300, 1360-70, 1410-20, 1500-1550, 1700.

In order to understand how the process of deciphering codes line by line is carried out, it is worth understanding that not a single code is a simple set of numbers. This is a code for a certain type of information.

For example, deciphering line 1230 of the balance sheet is accounts receivable.

For a liability, decoding occurs according to the same principle as in the situation with an asset:

The total liability is line 1700, which is the sum of line 1300 of the balance sheet, 1400 and 1500.

So, the process of deciphering the codes line by line in the balance sheet occurs on the basis of Appendix No. 4 to 66 Order of the Ministry of Finance. The structure of the codes themselves has a certain meaning. It is important to navigate in itself, or rather, in its sections and articles.

Quite often there is a need to transfer the balance sheet and profit and loss account from the old form (which was valid until 2011 inclusive) to the new form.

Unfortunately, it was not possible to find a convenient way to transfer old statements to new ones and vice versa, so you will have to manually remake the balance sheet and profit and loss account into a modern form.

To do this, you can use the following tables of correspondence between the line codes of the accounting reporting forms, compiled in accordance with the requirements of Order of the Ministry of Finance No. 67n, with the line codes designated by Order of the Ministry of Finance dated 07/02/2010 No. 66n

How to use it?

If you have a new balance sheet and income statement, and you need to convert them to the old form, then you need:

If you have an old balance sheet and profit and loss account, and you need to convert them to a new form, do this:

I found the tables themselves here: http://www.twirpx.com/file/808002/

Let's consider the technique of compiling balance sheet liabilities.

The procedure for filling out the “Capital and Reserves” section:

Line 410 “Authorized capital”. Line 410 records the amount of the authorized (share) capital, which is indicated in the constituent documents. According to the Civil Code of the Russian Federation, the authorized capital of an organization can be in the form of:

share capital - in a general partnership and limited partnership;

a mutual or indivisible fund - in a production cooperative;

authorized capital - in joint-stock companies, limited and additional liability companies;

authorized capital - in unitary state and municipal enterprises.

To fill out line 410 of the Balance Sheet, you need to take the credit balance of account 80 “Authorized capital”.

Line 411 “Own shares purchased from shareholders.” On line 411, the accountant must show the value of his own shares that were purchased from shareholders. It is worth noting that in the previous form of the balance sheet such shares had to be reflected in the second section of the balance sheet as part of short-term financial investments.

To fill out line 411 of the Balance Sheet, take the debit balance of account 81 “Own shares (shares)”.

Line 420 “Additional capital”. Line 420 of the Balance Sheet shows the amount of additional capital. Additional capital is formed through:

share premium of the joint stock company;

increase in the value of non-current assets;

positive exchange rate difference on foreign currency deposits in the authorized capital.

Previously, additional capital also included the value of property received free of charge from other legal entities and individuals. Currently, the value of gratuitously received assets is reflected as deferred income, that is, they must initially be taken into account in account 98 “Deferred income”.

To fill out line 420 of the Balance Sheet, you need to take the credit balance of account 83 “Additional capital”.

Line 430 “Reserve capital”. Line 430 reflects the balances of the reserve fund and other similar funds.

To fill out line 430 of the Balance Sheet, you need to take the credit balance of account 82 “Reserve capital”. Then information about reserve capital is listed on separate lines.

Line 431 “Reserves formed in accordance with legislation”. Line 431 shows the amount of mandatory reserve capital. This line can only be filled in by joint stock companies.

Line 432 “Reserves formed in accordance with the constituent documents.” Line 432 reflects reserves formed on the basis of the constituent documents of the enterprise.

Line 450 “Targeted financing”. Only non-profit organizations should include this line in their balance sheet. This line replaces the following group of items in these organizations: “Authorized capital”, “Reserve capital” and “Retained earnings (uncovered loss)”. This is established by paragraph 13 of the Instructions on the procedure for drawing up and presenting financial statements, which were approved by Order of the Ministry of Finance of Russia dated July 22, 2003 N 67n.

In line 450 of the Balance Sheet, non-profit organizations must show unused target funds. Such funds include entrance, membership, voluntary contributions, etc.

To fill out line 450, you need to know the credit balance of account 86 “Targeted financing”.

Line 470 “Retained earnings (uncovered loss)”. On line 470 of the Balance Sheet, you need to show both retained earnings (uncovered loss) of previous years and retained earnings (uncovered loss) of the reporting year. Previously, these indicators were always shown in separate lines.

It should be said that article 470 of the balance sheet should provide information on retained earnings (uncovered losses), taking into account the results of the organization’s activities for the year, decisions made on covering losses, paying dividends, etc.

To fill out line 470 of the Balance Sheet, you need to take the balance of account 84 “Retained profit (uncovered loss), in addition, you need to take into account all the entries for the distribution of profit or repayment of losses that were made at the end of 2003.

Line 490 “Total for Section III.” Line 490 of the Balance Sheet (form N 1) gives the sum of lines 410 “Authorized capital”, 420 “Additional capital”, 430 “Reserve capital” of the balance sheet, 470 “Retained earnings (uncovered loss)” (if you have a profit) minus the data on line 411 “Own shares purchased from shareholders”, 470 “Retained earnings (uncovered loss)” (if you have a loss).

2) The procedure for filling out section IV. "Long term duties":

Line 510 “Loans and credits”. Line 510 shows borrowed funds, the debt on which the company must repay in more than 12 months. The countdown begins on the 1st day of the calendar month following the month in which the loans were received.

The enterprise's debt on loans and borrowings is indicated taking into account accrued interest. This is established by paragraph 73 of the Regulations on accounting and financial reporting in the Russian Federation.

To fill out line 510 of the balance sheet, you need to take the credit balance of account 67 “Calculations for long-term loans and borrowings.”

It is worth noting that the new standard balance sheet form does not provide separate lines for deciphering long-term borrowed funds. However, if an organization borrows money from different sources, then debts to banks and other organizations can be given separately. To do this, you can use the lines that were in the old balance sheet.

Line 515 “Deferred tax liabilities.” On line 515 of the Balance Sheet, you need to show how much the company has deferred tax liabilities at the end of the year. The organization began calculating such obligations only this year. They were obliged to do this by the Accounting Regulations “Accounting for Income Tax Calculations” (PBU 18/02), which was approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n.

the amount of depreciation accrued in tax accounting is greater than that calculated according to accounting rules;

Interest on the loans was accrued monthly, and the debtor repaid them in a lump sum. In this case, the difference arises if the cash method is used;

interest on loans and amount differences in tax accounting are included in non-operating expenses, and in accounting - in the cost of fixed assets or materials (if a loan was taken to purchase this property);

In accounting, costs are reflected as deferred expenses, and in tax accounting they are written off immediately. For example, the cost of electronic databases. If the contract does not specify the period during which they need to be written off, then the manager sets it.

Once the deferred tax liability has been determined, it must be reflected in the accounting records. First of all, such an obligation should be reflected in the analytical accounting of the corresponding account of assets and liabilities in the valuation of which the taxable temporary difference arose.

To fill out balance sheet 515, you need to take the credit balance of account 77 “Deferred tax liabilities.”

Line 520 “Other long-term liabilities”. Line 520 includes the amounts of attracted long-term liabilities of the organization that were not indicated in lines 510 and 515.

Line 590 “Total for Section IV.” Line 590 indicates the amount of lines 510 “Loans and credits”, 515 “Deferred tax liabilities” and 520 “Other long-term liabilities” of the balance sheet.

3) Completing section V. “Short-term liabilities”

Line 610 “Loans and credits”. Line 610 records outstanding loans and borrowings that the organization took out for a period of less than 12 months. In addition, debt that was considered long-term in previous reporting periods, but must be repaid this year, may also be reflected here. To fill out line 610, you need to take the credit balance of account 66 “Calculations for short-term loans and borrowings.”

The new balance sheet form does not have separate lines for detailing short-term borrowings. However, if an organization borrows money from different sources, then debts to banks and other organizations can be given separately. To do this, you can use the lines that were in the old balance sheet. So, on line 611 you can enter the amount of short-term loans, and on line 612 - the amount of short-term loans.

Line 620 “Accounts payable.” Line 620 of the Balance Sheet indicates accounts payable. The details of these funds are then detailed on separate balance sheet lines.

Line 621 “Suppliers and contractors.” Line 621 records the debt to suppliers and contractors for received material assets (work performed, services rendered).

To fill out line 621, you need to take the credit balance of account 76 “Settlements with various debtors and creditors” subaccount “Settlements with suppliers and contractors” and the credit balance of account 60 “Settlements with suppliers and contractors” subaccount “Settlements for shipped products”.

Line 622 “Debt to the organization’s personnel.” Line 622 of the Balance Sheet indicates wages accrued but not yet paid to employees. To fill out line 624, you need to take the credit balance of account 70 “Settlements with personnel for wages”.

Line 623 “Debt to state extra-budgetary funds.” Line 623 of the Balance Sheet shows the debt for the unified social tax, as well as for compulsory pension insurance and compulsory insurance against industrial accidents and occupational diseases.

To fill out line 623, take the credit balance of account 69 “Calculations for social insurance and security”.

Line 624 “Debt on taxes and fees”. Line 624 of the Balance Sheet indicates the debt to the budget.

To fill out line 624, you should take the credit balance of account 68 “Calculations for taxes and fees” (excluding the subaccounts “Debt of tax authorities, repayment of which is expected after 12 months” and “Debt of tax authorities, repayment of which is expected within 12 months”).

Line 625 “Other creditors”. Line 625 of the Balance Sheet indicates the organization's accounts payable, which are not reflected in lines 621-627. In particular, this line reflects debt to accountable persons, debt for deposited wages, debt for property and employee insurance, etc.

To fill out line 625, you should know, for example, the credit balances of accounts 71 “Settlements with accountable persons”, 76 “Settlements with various debtors and creditors”, subaccounts “Settlements for property and personal insurance” and “Settlements for claims”.

Line 630 “Debt to participants (founders) for payment of income.” Line 630 of the Balance Sheet shows the organization's debt for dividends and interest that have already been accrued but not yet paid.

To fill out line 630 of the Balance Sheet, you need to take: the credit balance of account 75 “Settlements with founders” subaccount “Settlements for payment of income”.

Line 640 “Deferred income”. Line 640 of the Balance Sheet reflects the enterprise's income that relates to future reporting periods, but was received already this year. Such income, in particular, includes receipt of rent in advance several months in advance, targeted budget revenues to commercial organizations, the cost of property received free of charge, etc.

To fill out line 640 of the Balance Sheet, you need to take the credit balance of account 98 “Deferred income”, and for non-profit organizations - also the credit balance of account 86 “Targeted financing”.

Line 650 “Reserves for future expenses.” Line 650 of the Balance Sheet indicates the amounts that the organization has reserved to cover its future costs. In accordance with paragraph 72 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, enterprises can create reserves for:

upcoming payment of vacations to employees;

payment of annual remuneration for long service;

payment of remuneration based on the results of work for the year;

repair of fixed assets;

production costs for preparatory work due to the seasonal nature of production;

upcoming costs for land reclamation and other environmental measures;

upcoming costs of repairing items intended for rental under a rental agreement;

warranty repairs and warranty service;

covering other anticipated costs.

To fill out line 650 of the Balance Sheet, you need: credit balance of account 96 “Reserves for future expenses.”

Line 660 “Other short-term liabilities”. Line 660 of the Balance Sheet reflects the amounts of short-term liabilities that cannot be classified as other items in the “Short-term liabilities” section.

Line 690 “Total for Section V.” On line 690 enter the sum of lines 610 “Loans and credits”, 620 “Accounts payable”, 630 “Debt to participants (founders) for payment of income”, 640 “Deferred income”, 650 “Reserves for future expenses” and 660 “Other short-term liabilities" balance sheet.

Line 700 “Balance”. On line 700 the sum of lines 490 “Total for Section III”, 590 “Total for Section IV” and 690 “Total for Section V” is entered.